Jiangling returns to the top spot, with impressive gains from Maxus, JAC, and Golden Dragon. October light commercial vehicle sales ranking.

Release time:

2021-12-10

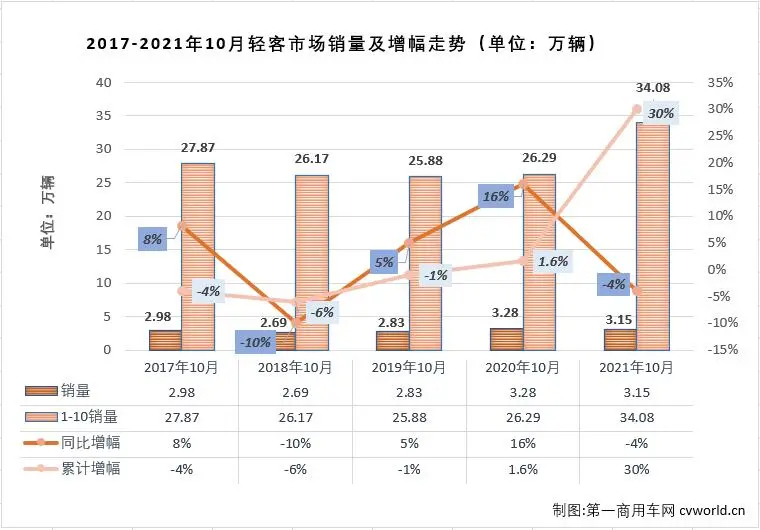

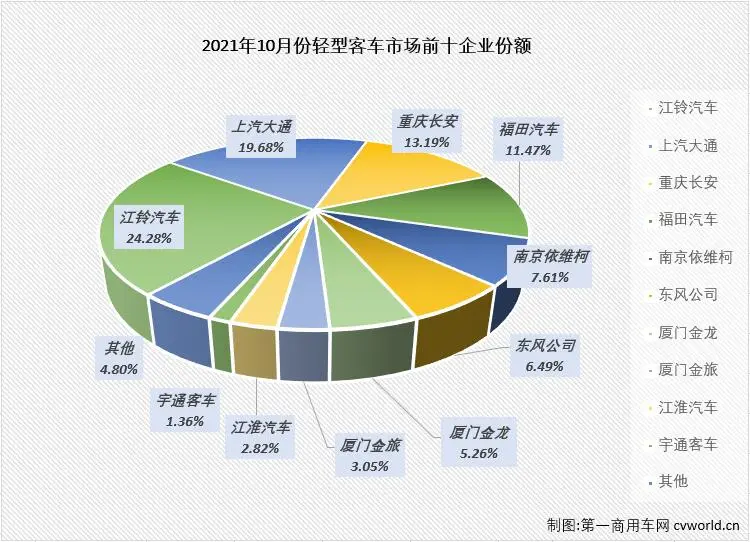

The light commercial vehicle (LCV) market, as the largest segment of the bus market, has a significant impact on the overall trends of the bus market. In September 2021, the LCV market experienced its first decline of the year, which directly led to the first decline of the entire bus market in 2021. Will the LCV market cause the bus market to face consecutive declines in October with its "own strength"? According to the latest data from the China Association of Automobile Manufacturers, in October 2021, the bus market (including incomplete vehicles) in China sold 39,000 units, a month-on-month decrease of 1% and a year-on-year decrease of 9%, marking the first "consecutive decline" of 2021. Among these, the sales of light commercial vehicles reached 31,500 units, a year-on-year decrease of 4%, also experiencing a consecutive decline. The decline in the LCV market is a major reason for the overall downturn in the bus market. In October, the sales of 31,500 light commercial vehicles accounted for 80.86% of the entire bus market, a slight decrease from the previous month (82.16%). Looking at the sales and growth trends of light commercial vehicles in October over the past five years, it can be seen that the LCV market has shown a pattern of increase-decrease-increase-increase-decrease. The sales of light commercial vehicles in October over the past five years have not varied much, concentrated in the range of 27,000 to 33,000 units, with two years exceeding 30,000 units in October. The sales of 31,500 units in October 2021 is the second highest in the past five years, about 1,300 units less than the highest sales in October 2020. In terms of cumulative sales, from January to October 2021, the LCV market sold a total of 340,800 units, the best performance for the first ten months in the past five years. In 2021, the LCV market broke through 200,000 units for the first time after June and also surpassed 300,000 units for the first time after September in the past five years. As shown in the chart, from 2017 to 2020, the LCV market did not exceed 300,000 units after October. Overall, the performance of the LCV market in 2021 is outstanding. The sales table for the light commercial vehicle market in October 2021 (units: vehicles) shows that the LCV market experienced a year-on-year decline of 4%. Among the top ten companies in October sales, five increased and five decreased. Two companies achieved double-digit growth, with Chongqing Changan ranking third and Xiamen Jinlong ranking seventh, both achieving a sales increase of 19% in October. SAIC Maxus, Dongfeng, and JAC Motors saw year-on-year increases of 3%, 3%, and 9%, respectively, as the other three companies that achieved growth. Among the five companies that experienced declines, three had double-digit decreases, with the most severe decline being 31%. Foton Motor and Xiamen Golden Dragon had declines of 1% and 2%, respectively, outperforming the overall LCV market. In terms of market share, the top ten companies accounted for a total of 95.20% of the market in October, with the top five companies accounting for 76.22%. These five companies captured more than three-quarters of the LCV market in October, with the top four companies each exceeding 10% market share. Jiangling Motors, which returned to the top of the monthly sales chart, was the only company with a monthly share exceeding 20%, reaching 24.28%. SAIC Maxus followed closely with a share of 19.68%, while Changan and Foton had shares of 13.19% and 11.47%, respectively. Nanjing Iveco, ranked fifth in October sales, had a share of 7.61%. From January to October 2021, the LCV market achieved cumulative sales of 340,800 units, a year-on-year increase of 30%. The cumulative growth rate narrowed by 4 percentage points compared to the first nine months (+34%), with approximately 78,000 more units sold than the same period last year. Looking specifically at the top ten companies in October sales, all ten companies were in the growth range, with the highest increase being SAIC Maxus, which sold 65,800 units from January to October, a year-on-year increase of 50%, exceeding last year's total sales (SAIC Maxus sold 59,700 units in 2020) by more than 6,000 units. Chongqing Changan, Dongfeng, and Nanjing Iveco had cumulative sales growth rates of 47%, 30%, and 39%, respectively, outperforming the overall LCV market. Jiangling Motors, ranked first in cumulative sales, had a cumulative growth rate of 23%, selling 15,300 more units than the same period last year. In 2021, the LCV market achieved the only "8 consecutive increases" in the bus market. Although it faced consecutive declines in September and October, after October, the cumulative sales of the LCV market reached 340,800 units, almost on par with the total sales for 2020 (344,300 units), and nearly 80,000 more units than the same period last year, which is roughly equivalent to more than two months of sales for the LCV market. With only two months left in 2021, it is almost certain that the LCV market will exceed last year's total sales after November, and it is highly likely to be the only segment of the bus market to achieve growth in 2021.

The light commercial vehicle market, as the largest segment of the bus market, has a huge impact on the overall trend of the bus market.2021Year9In the month of2021the first decline in the year, the decline in the light commercial vehicle market directly led to the overall bus market2021the first decline in the year,10In the month, will the light commercial vehicle market cause the bus market to experience consecutive declines by "its own strength"?

According to the latest information from the First Commercial Vehicle Network, based on the production and sales data from the China Association of Automobile Manufacturers,2021Year10In the month, the sales of the bus market (including incomplete vehicles) in our country reached3.9ten thousand units, a month-on-month decrease of1%.A year-on-year decrease of9%.Encountering2021the first "consecutive decline" in the year. Among them, the sales of light commercial vehicles3.15ten thousand units, a year-on-year decrease of4%.The consecutive decline in the light commercial vehicle market is also the main reason for the overall decline in the bus market.10In the month, the sales of light commercial vehicles3.15ten thousand units accounted for80.86%.Compared to last month (82.16%.).

Looking back over the past five years10The sales and growth trend chart of light commercial vehicles in the month shows that in recent5Year10the light commercial vehicle market has shown a trend of increase-and decrease.-Increase.-Increase.-Decrease.5Year10In recentthe sales of light commercial vehicles are not much different, concentrated in the range of2.7-3.32Year10ten thousand units, among which there are3the sales in the month exceeded2021Year10ten thousand units,3.15the sales of the light commercial vehicle market in the month is the second highest in recent5years, about5less than the highest sales in the year.2020Year10In the month.1300.

From the cumulative sales perspective,2021YearFrom January to Octoberthe cumulative sales of the light commercial vehicle market reached34.08ten thousand units, the best performance in recent5years in the first10months.2021In the year, the light commercial vehicle market5for the first time in years after the month exceeded6ten thousand units, which is also the first time in years for the light commercial vehicle market to exceed20ten thousand units after the month.5As seen in the above chart,9From 2017 to 202030In the four years, the light commercial vehicle market did not exceedten thousand units after the month.From the overall data perspective,10the performance of the light commercial vehicle market in the year is outstanding.30The sales table of the light commercial vehicle market in the month (unit: units)2021As seen in the above table,

2021Year10In the month, the light commercial vehicle market experienced a year-on-year decline.

Specifically, in the month, looking at the top ten companies in sales, ten companies10declined, and the companies that achieved growth are4%.companies with double-digit growth, with Chongqing Changan ranked third and Xiamen Golden Dragon ranked seventh.10In the month, the sales growth rate of both reached5Increase.519%.2SAIC Maxus, Dongfeng Company, and Jianghuai Automobile three companies10In the month, the sales of light commercial vehicles increased by3%,and10are the other three companies that achieved growth.In the month, there werethree companies that experienced a decline, with three companies experiencing a double-digit decline, and the most severe decline was a year-on-year decrease ofIn the month, there were31%.9%.Foton Motor and Xiamen Jinlv two companies had declines of102%.5Outperforming the light commercial vehicle market as a whole.From the perspective of market share, the top ten companies in salesIn the month, the total share reached1%.three companies that experienced a decline, with three companies experiencing a double-digit decline, and the most severe decline was a year-on-year decrease of95.20%.The top five companies accounted for a total share of

76.22%.10The companies sharedIn the month, the light commercial vehicle market exceeded3/4of the share, among which the companies ranked in the topthe monthly share exceeded510%.10月份轻客市场超3/4的份额,其中排名前4位的企业月度份额超过10%Jiangling Motors, which returned to the top of the monthly sales chart, is the only company with a monthly share exceeding20%, reaching24.28%, with SAIC Maxus ranking second, its share is also close to20%, reaching19.68%, while Changan and Foton's10monthly shares are13.19%31%.11.47%, ranking10the monthly sales chart5Nanjing Iveco ranked10the monthly share is7.61%.

From the cumulative sales perspective,2021YearFrom January to OctoberIn the month, the light commercial vehicle market accumulated sales of34.08units, a year-on-year cumulative growth of30%, the cumulative increase narrowed compared to the previous9month (+34%)4percentage points, about7.8units more than the same period last year.10Looking at the top ten companies in monthly sales, all ten companies are in the rising range, with the highest increase being SAIC Maxus, which ranks second in cumulative sales. This year, SAIC MaxusFrom January to Octoberhas accumulated sales of6.58units, a year-on-year cumulative growth of50%, which is higher than last year's total sales (SAIC Maxus2020accumulated sales of light commercial vehicles5.97units) by more than6000units; Chongqing Changan, Dongfeng Company, and Nanjing Iveco's cumulative sales growth rates reached47%three companies that experienced a decline, with three companies experiencing a double-digit decline, and the most severe decline was a year-on-year decrease of30%31%.39%, outpacing the light commercial vehicle market as a whole, with Jiangling Motors, which ranks first in cumulative sales, having a cumulative increase of23%, selling about1.53units more than the same period last year.

2021In the year, the light commercial vehicle market achieved the only "continuous increase" in the bus market,8although9and10encountered consecutive declines in the months, but after10the month, the light commercial vehicle market accumulated sales of34.08units, almost equal to2020last year's total sales (34.43units) and nearly8units more than the same period last year, which is almost the sales of the light commercial vehicle market for more than2months.2021With two months left in the year, it is certain that the light commercial vehicle market will exceed last year's total sales after11the month, and it is highly likely that the light commercial vehicle market will become2021the only segment in the bus market to achieve growth this year.

Latest News