Which brand tops the list with a difference of a hundred vehicles between Jiangling and Maxus? Changan, Jinlv, and others have achieved growth. Here are the top ten light commercial vehicle sales rankings for November.

Release time:

2021-12-27

The light commercial vehicle (LCV) market, as the largest segment of the bus market, has a significant impact on the overall trends of the bus market. In the first eight months of 2021, the continuous growth of the LCV market led to an "8-month consecutive increase" in the bus market. However, in September and October, the continuous decline in the LCV market directly caused the entire bus market to experience a "2-month consecutive decline." Will the LCV market continue to cause the bus market to decline in November? According to the latest data from the China Association of Automobile Manufacturers, in November 2021, the bus market (including incomplete vehicles) in China sold 40,000 units, a month-on-month increase of 2% but a year-on-year decrease of 16%, marking a "three-month consecutive decline." Among these, the light bus market sold 31,500 units, a year-on-year decrease of 13%, creating the largest decline in 2021 and also experiencing a "three-month consecutive decline." The continuous decline in the LCV market is the main reason for the overall decline in the bus market. In November, the sales of 31,500 light buses accounted for 78.92% of the entire bus market, a slight decrease from the previous month (80.86%). Looking at the sales and growth trends of light buses in November over the past five years, it can be seen that the LCV market has shown a trend of decline-increase-increase-increase-decline in November. The sales of light buses in November over the past five years have not varied much, concentrated in the range of 31,000 to 36,000 units. Notably, the sales in November 2019 and 2020 exceeded 35,000 units, while the sales of 31,500 units in November 2021 are at a relatively low level compared to the highest sales in November 2020, which sold about 4,700 units more. In terms of cumulative sales, from January to November 2021, the LCV market sold a total of 372,400 units, the best performance for the first eleven months in the past five years. In 2021, the LCV market broke through 200,000 units for the first time after June and also surpassed 300,000 units for the first time after September, as shown in the chart. In the four years from 2018 to 2020, the LCV market did not exceed 300,000 units after November. After November, the cumulative sales of 372,400 units have successfully surpassed the total sales for the entire year of 2020 (344,200 units), indicating that the performance of the LCV market in 2021 is still outstanding. The sales table for the light bus market in November 2021 (units: vehicles) shows that the light bus market experienced a year-on-year decline of 13%. Among the top ten companies in November sales, five increased and five decreased, with the companies that achieved growth having double-digit increases. The highest increase was from Xiamen Jinlv, ranked 8th in monthly sales, with an increase of 78%. Xiamen King Long also saw an increase of over 50%, reaching 51%. SAIC Maxus and Chongqing Changan, ranked 2nd and 3rd, increased by 12% and 16% year-on-year, respectively. Nanjing King Long's light bus sales in November increased by 22% year-on-year, making it another company with double-digit growth. Among the five companies that experienced a decline in November, four had double-digit decreases, with the most significant decline being 32% year-on-year. In terms of market share, the top ten companies accounted for a total of 94.58% of the market in November, with the top five companies holding a combined share of 77.86%. These five companies captured more than three-quarters of the light bus market in November, with the top four companies each exceeding 10% market share. The top two companies, Jiangling Motors and SAIC Maxus, both exceeded 20% in November, reaching 24.36% and 24.03%, respectively, with a sales gap of only 105 vehicles, indicating a fierce competition for the top position. Changan and Foton, ranked 3rd and 4th, had market shares of 12.13% and 10.90%, respectively, while Nanjing Iveco, ranked 5th in November sales, had a market share of 6.45%. From January to November 2021, the LCV market achieved cumulative sales of 372,400 units, a year-on-year increase of 24%. The cumulative growth rate narrowed by 6 percentage points compared to the first ten months (+30%), with approximately 73,200 more units sold than the same period last year. Among the top ten companies in November sales, nine increased and one decreased, with most companies in the growth range. The highest increase was from SAIC Maxus, ranked second in cumulative sales, which sold 73,400 units from January to November, a year-on-year increase of 45%, surpassing last year's total sales (SAIC Maxus sold 59,700 units in 2020) by 13,700 units. Chongqing Changan, Dongfeng Company, and Xiamen Jinlv had cumulative sales growth rates of 44%, 29%, and 29%, respectively, outperforming the overall LCV market. Jiangling Motors, ranked first in cumulative sales, had a cumulative growth rate of 14%, selling 11,200 more units than the same period last year. In 2021, the LCV market achieved the only "8 consecutive increases" in the bus market. Although it faced consecutive declines from September to November, after November, the cumulative sales of the LCV market reached 372,400 units, successfully surpassing the total sales for the entire year of 2020 (344,300 units), with nearly 30,000 more units sold than last year. With only one month left in 2021, unless there are miracles in the large and medium bus markets, the LCV market is likely to be the only segment in the bus market to achieve growth in 2021.

The light commercial vehicle market, as the largest segment of the bus market, has a significant impact on the overall trend of the bus market.In the first eight months of 2021, the continuous growth of the light commercial vehicle market led to an "8 consecutive increases" in the bus market. However, the decline in the light commercial vehicle market in September and October directly resulted in a "2 consecutive declines" in the overall bus market. Will the light commercial vehicle market continue to cause a decline in the bus market in November?

According to the latest information from the China Association of Automobile Manufacturers,In November 2021, the sales of the bus market (including incomplete vehicles) in China reached 40,000 units, a month-on-month increase of 2% but a year-on-year decrease of 16%, resulting in a "three consecutive declines." Among these, the sales of the light commercial vehicle market were 31,500 units, a year-on-year decrease of 13%, marking the largest decline in 2021 and contributing to the overall decline in the bus market. In November, the sales of 31,500 light commercial vehicles accounted for 78.92% of the entire bus market, a slight decrease from the previous month (80.86%).

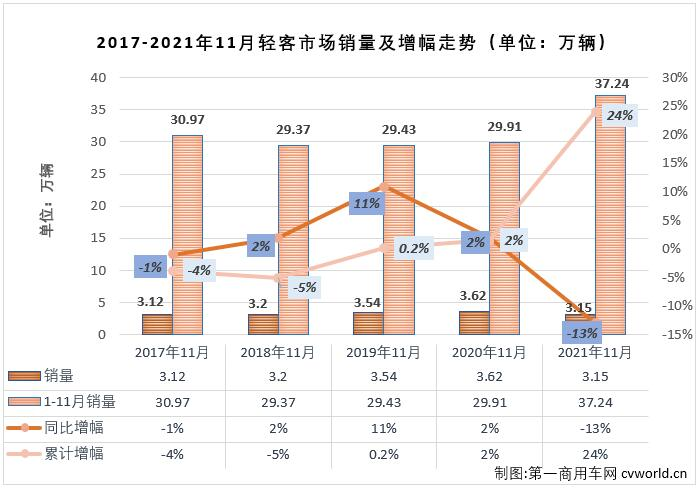

Looking back over the past five yearsThe sales and growth trend chart of light commercial vehicles in November shows that in the past five years, the light commercial vehicle market in November has exhibited a trend of decline-increase-increase-increase-decline. The sales in November over the past five years have not varied much, concentrated in the range of 31,000 to 36,000 units, with sales exceeding 35,000 units in November 2019 and 2020. The sales of 31,500 units in November 2021 are at a relatively low level compared to the highest sales in November 2020, which was about 4,700 units higher.

From the perspective of cumulative sales,From January to November 2021, the cumulative sales of the light commercial vehicle market reached 372,400 units, the best performance for the first eleven months in the past five years. In 2021, the light commercial vehicle market broke through 200,000 units for the first time after June, and also surpassed 300,000 units for the first time after September in the past five years. As shown in the above chart, in the four years from 2018 to 2020, the light commercial vehicle market did not exceed 300,000 units after November. After November, the cumulative sales of 372,400 units have successfully surpassed the total sales for the entire year of 2020 (344,200 units), indicating that the performance of the light commercial vehicle market in 2021 is still outstanding.

Sales table of the light commercial vehicle market in November 2021 (units: vehicles)

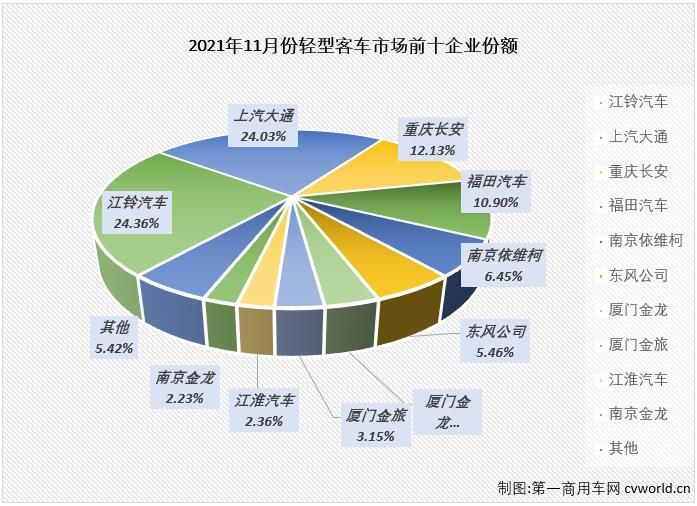

As seen in the above table,In November, the light commercial vehicle market experienced a year-on-year decline of 13%. Looking at the top ten companies in terms of November sales, five companies increased and five decreased, with the companies that achieved growth having double-digit increases. The highest increase was from Xiamen Jinlv, ranked 8th in monthly sales, reaching 78%. Xiamen Jinlong also exceeded 50%, reaching 51%. SAIC Maxus and Chongqing Changan, ranked 2nd and 3rd, saw year-on-year increases of 12% and 16%, respectively. Nanjing Jinlong's light commercial vehicle sales in November increased by 22% year-on-year, making it another company with double-digit growth. Among the five companies that experienced a decline in November, four had double-digit decreases, with the most severe decline being 32% year-on-year.

From the perspective of market share, the top ten companies in salesIn November, the total market share reached 94.58%, with the top five companies accounting for 77.86% of the total. These five companies captured more than three-quarters of the light commercial vehicle market in November, with the top four companies each exceeding 10% market share. The top two companies, Jiangling Motors and SAIC Maxus, both exceeded 20% in November, reaching 24.36% and 24.03%, respectively, with a sales difference of only 105 vehicles, indicating a very competitive race for the top position. Changan and Foton, ranked 3rd and 4th, had market shares of 12.13% and 10.90%, respectively, while Nanjing Iveco, ranked 5th in November sales, had a market share of 6.45%.

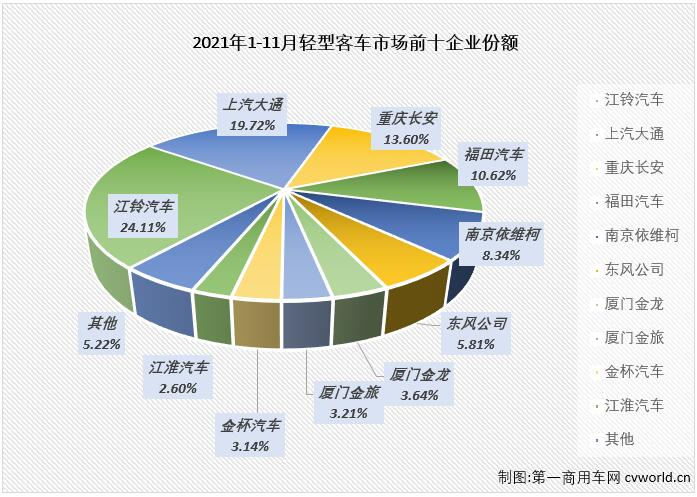

From the perspective of cumulative sales,From January to November 2021, the cumulative sales of the light commercial vehicle market reached 372,400 units, a year-on-year cumulative growth of 24%. The cumulative growth rate narrowed by 6 percentage points compared to the previous ten months (+30%), with approximately 73,200 more units sold than the same period last year. Looking specifically at the top ten companies in November sales, nine companies increased and one decreased, with most companies in the rising range. The highest increase was from SAIC Maxus, ranked second in cumulative sales, which achieved cumulative sales of 73,400 units from January to November, a year-on-year increase of 45%, surpassing last year's total sales (SAIC Maxus 2020 cumulative sales of light commercial vehicles was 59,700 units) by 13,700 units. Chongqing Changan, Dongfeng Company, and Xiamen Jinlv had cumulative sales growth rates of 44%, 29%, and 29%, respectively, outperforming the overall light commercial vehicle market. Jiangling Motors, ranked first in cumulative sales, had a cumulative growth rate of 14%, selling 11,200 more units than the same period last year.

In 2021, the light commercial vehicle market achieved the only "8 consecutive increases" in the bus market. Although it faced consecutive declines from September to November, after November, the cumulative sales of 372,400 units successfully surpassed the total sales for the entire year of 2020 (344,300 units), with nearly 30,000 more units sold than last year. With only one month left in 2021, unless there are miracles in the large and medium bus markets, the light commercial vehicle market is likely to be the only segment in the bus market to achieve growth in 2021.

Latest News