Weichai 920,000, Yuchai over 510,000, Shangchai/Quanchai leading the rise. In the first 11 months, diesel engine sales reached 5.64 million units, a slight decrease.

Release time:

2021-12-27

As 2021 comes to an end, what kind of report will the diesel engine market in our country present? According to data released by the China Internal Combustion Engine Industry Association, from January to November 2021, the sales trend of the internal combustion engine market showed a pattern of "5 consecutive increases + 6 consecutive decreases" year-on-year; for diesel engines, closely related to the commercial vehicle industry, the market sales trend was "4 consecutive increases + 7 consecutive decreases". It can be seen that as the sales of the commercial vehicle market continue to decline, the diesel engine market is also becoming increasingly "cold". In the last month of 2021, the market decline was almost a foregone conclusion due to the high base effect from the previous year. In the first 11 months, 5.64 million diesel engines were sold, with the cumulative growth rate turning negative. In November 2021, the sales of internal combustion engines in China reached 4.6702 million units, an increase of 11.24% month-on-month, but a decrease of 4.05% year-on-year; from January to November, the cumulative sales of internal combustion engines reached 45.5918 million units, a year-on-year increase of 8.93%. Among them, in November 2021, diesel engine sales were 434,900 units, an increase of 13.25% month-on-month, but a decrease of 27.06% year-on-year; from January to November, cumulative diesel engine sales reached 5.6403 million units, with a cumulative growth rate turning negative, down 1.75% year-on-year. Sales of multi-cylinder diesel engines in November were 366,000 units, an increase of 7.82% month-on-month, but a decrease of 26.11% year-on-year; from January to November, cumulative sales reached 4.9244 million units, a year-on-year increase of 1.6%. Sales of multi-cylinder diesel engines for commercial vehicles in November were 183,500 units, an increase of 3.28% month-on-month, but a decrease of 39.64% year-on-year; from January to November, cumulative sales of commercial vehicle diesel engines reached 2.7688 million units, a year-on-year decrease of 6.88%. Note: The percentage data on the trend chart refers to multi-cylinder diesel engines for commercial vehicles. It can be seen that from January to November 2021, diesel engine sales accounted for 12.37% of the internal combustion engine market, a decrease of 1.35 percentage points compared to the same period last year (13.72%); in the diesel engine sector, the proportion of commercial vehicle matching accounted for 49.09%, down 2.71 percentage points from the same period last year (51.8%). So, what changes occurred in the market structure of various enterprises from January to November 2021? Multi-cylinder diesel engines: Weichai 920,000 units, Yuchai over 510,000 units, 6 companies still showing growth. From the market distribution of multi-cylinder diesel engine enterprises published by the China Internal Combustion Engine Industry Association, from January to November 2021, the top ten enterprises accounted for 77.73% of cumulative sales, a decrease of 1.43 percentage points compared to the same period last year (79.16%). Horizontally, the cumulative sales share of the top ten enterprises was highest in January, reaching 80.32%, and then gradually narrowed as the months progressed. From the table above, it can be seen that from January to November 2021, Weichai Holdings sold a total of 922,800 multi-cylinder diesel engines, a year-on-year decrease of 0.65%, with a market share of 18.74%, maintaining the industry’s top position; Yuchai ranked second, with sales exceeding 510,000 units in the first 11 months, a year-on-year increase of 8.24%, with a market share of 10.46%; Yunnei Power ranked third, with sales of 444,700 units in the first 11 months, a year-on-year decrease of 17.45%, with a share of 9.03%. Among the seven companies outside the top three, five companies still maintained a year-on-year growth trend, namely Anhui Quanchai, Jiangling Motors, Zhejiang Xinchai, Dongfeng Cummins, and Shanghai Diesel Engine; among them, Shanghai Diesel Engine had the highest growth rate in the industry, reaching 34.4%. Compared to the same period last year, the market structure has changed significantly. Except for Weichai maintaining its first position and Dongfeng Cummins remaining ninth, the rankings of other companies in the top ten have changed. Notably, Shanghai Diesel Engine successfully entered the top ten due to its outstanding market growth in 2021; compared to January to October 2021, the market structure of multi-cylinder diesel engines only showed slight changes, reflected in the position swap between Jiangling Motors and Jiefang Power. Overall, the multi-cylinder diesel engine market in 2021 experienced significant fluctuations, influenced by many factors, including power rationing, supply-demand conflicts in raw materials, and repeated pandemic outbreaks. The weak demand in the main supporting commercial vehicle market also had a considerable impact. Multi-cylinder diesel engines for commercial vehicles: Fokang vs. Yuchai, Jiefang vs. Yunnei, Shanghai Diesel Engine catching up with Dongkang, competition intensifying. Multi-cylinder diesel engines for commercial vehicles, also known as "diesel engines for commercial vehicles." From January to November 2021, the sales of multi-cylinder diesel engines for commercial vehicles reached 2.7688 million units, accounting for 56.23% of multi-cylinder diesel engines. This means that for every two multi-cylinder diesel engines sold, at least one is used for commercial vehicle matching. However, compared to the continuous narrowing of the cumulative sales share of the top ten multi-cylinder diesel engine enterprises, the multi-cylinder diesel engines for commercial vehicles present a different picture. From January to April 2021, the cumulative share of the top ten enterprises for multi-cylinder diesel engines for commercial vehicles remained above 89%, peaking at 89.88% in February; starting in May, the cumulative share of the top ten fell below 89%, especially from July onwards, it gradually narrowed for five consecutive months. Currently, from January to November, the cumulative share of the top ten enterprises for multi-cylinder diesel engines for commercial vehicles is 88.32%, which is 0.51 percentage points lower than the same period last year. From the perspective of enterprises, from January to November 2021, Weichai Holdings ranked first, with cumulative sales of commercial vehicle diesel engines reaching 603,900 units, with a share of 21.81%; Jiangling ranked second, with cumulative sales of commercial vehicle diesel engines reaching 307,600 units, a year-on-year increase of 2.27%; Foton Cummins and Yuchai are competing for third place, with both having sales of over 260,000 units, with a difference of about 2,000 units; Yunnei Power and Jiefang Power also had similar sales, both exceeding 240,000 units, with a difference of less than 7,000 units; Quanchai exceeded 150,000 units, ranking seventh, while Dongkang and Shanghai Diesel Engine were both at the 120,000 unit level, and Jianghuai approached 100,000 units. Overall, the competition in the commercial vehicle diesel engine market intensified in 2021. Jiangling, Quanchai, Shanghai Diesel Engine, and Jianghuai achieved year-on-year positive growth even in a sluggish market, with cumulative sales at a relatively high level. In terms of market structure, there was no change compared to January to October 2021; compared to the same period last year, Jiangling and Quanchai each rose one position, while Fokang and Yuchai each rose two positions. Notably, both Jiangling and Quanchai achieved increases in both multi-cylinder diesel engine and commercial vehicle diesel engine sales and shares. The increase in Jiangling's commercial vehicle diesel engine sales is closely related to the rise in sales of Jiangling's light passenger vehicles, pickups, and light trucks. According to production and sales reports, Jiangling's light passenger vehicle sales reached 91,000 units, an increase of 13.85% in the first 11 months of 2021, with pickup sales of 59,000 units, an increase of 3.4%, and truck sales reaching 107,000 units; engine production capacity is also increasing, with the 4D30 assembly line capacity optimization project and the PUMA assembly line relocation project both going offline in March, with a production target of over 9,000 units in December for the assembly workshop. In 2021, affected by the upgrade of National VI emissions and the new regulations for blue card light trucks, the sales of the commercial vehicle market fluctuated, which in turn led to significant fluctuations in the diesel engine market related to commercial vehicle matching. However, various engine companies actively responded, moving forward amid opportunities and challenges, with each showing highlights in market performance. For example, Weichai's heavy-duty vehicle power performance reached a historical best, with an expected market share exceeding 32% in 2021, and sales of National VI products exceeding 150,000 units, facing the launch of the WP7H engine for the cargo vehicle market in 2022; Yuchai's National VI orders continued to increase, strengthening cooperation with enterprises, and launching strategic new products in collaboration with Dayun, United Trucks, and Sanhuan; Jiefang Power's Jinwei products continued to increase in Jiefang light trucks, with its Aowei 16L engine "super factory" about to be put into production; Foton Cummins, Yunnei Power, Jiefang Power, and Oukan Power launched new 2.5-liter diesel engines targeting the new regulations for blue card light trucks; Quanchai actively adjusted its product structure, implemented cost reduction and efficiency enhancement measures, and launched high-end power products for National VI... Conclusion As 2022 approaches, industry forecasts suggest that the heavy truck market sales may only reach 1 million units, while the market for 500-horsepower tractors, cargo vehicles, and special vehicles is optimistic. At the same time, the new regulations for blue card light trucks will officially take effect, and the commercial vehicle power market is brewing a major transformation. Under the multiple influences of the trend towards new energy, new regulations, and new opportunities, what new breakthroughs will various engine companies achieve in 2022?

As 2021 comes to an end, what kind of report will our country's diesel engine market present?

According to data released by the China Internal Combustion Engine Association,From January to November 2021, the sales trend of the internal combustion engine market showed a year-on-year "5 consecutive increases + 6 consecutive decreases"; the diesel engine, closely related to the commercial vehicle industry, had a sales trend of "4 consecutive increases + 7 consecutive decreases."

It can be seen that as the sales of the commercial vehicle market continue to decline, the diesel engine market is also increasingly showing a "cold" trend.In the last month of 2021, affected by a high base year-on-year, a market decline is almost a foregone conclusion.

PreviousIn November, diesel engine sales were 564,000 units, with cumulative growth turning negative.

In November 2021, domestic internal combustion engine sales were 4.6702 million units, a month-on-month increase of 11.24%, and a year-on-year decrease of 4.05%; from January to November, cumulative internal combustion engine sales were 45.5918 million units, a year-on-year increase of 8.93%.

Among them,In November 2021, diesel engine sales were 434,900 units, a month-on-month increase of 13.25%, and a year-on-year decrease of 27.06%; from January to November, cumulative diesel engine sales were 5.6403 million units, with cumulative growth turning negative, a year-on-year decrease of 1.75%.

Multi-cylinder diesel enginesIn November, sales were 366,000 units, a month-on-month increase of 7.82%, and a year-on-year decrease of 26.11%; from January to November, cumulative sales were 4.9244 million units, a year-on-year increase of 1.6%.

Multi-cylinder diesel engines for commercial vehicles (also known as"diesel engines for commercial vehicles") sold 183,500 units in November, a month-on-month increase of 3.28%, and a year-on-year decrease of 39.64%; from January to November, cumulative sales of diesel engines for commercial vehicles were 2.7688 million units, a year-on-year decrease of 6.88%.

Note: The percentage data on the trend chart refers to multi-cylinder diesel engines for commercial vehicles.

Note: The percentage data on the trend chart refers to multi-cylinder diesel engines for commercial vehicles.

It can be seen that,From January to November 2021, diesel engine sales accounted for 12.37% of the internal combustion engine market, a decrease of 1.35 percentage points compared to 13.72% in the same period last year; in the diesel engine sector, the proportion of commercial vehicle matching accounted for 49.09%, a decrease of 2.71 percentage points compared to 51.8% in the same period last year.

So, specifically for each company,What changes occurred in the market pattern from January to November 2021?

Multi-cylinder diesel engines: Weichai920,000 units, Yuchai over 510,000, 6 companies still showing growth.

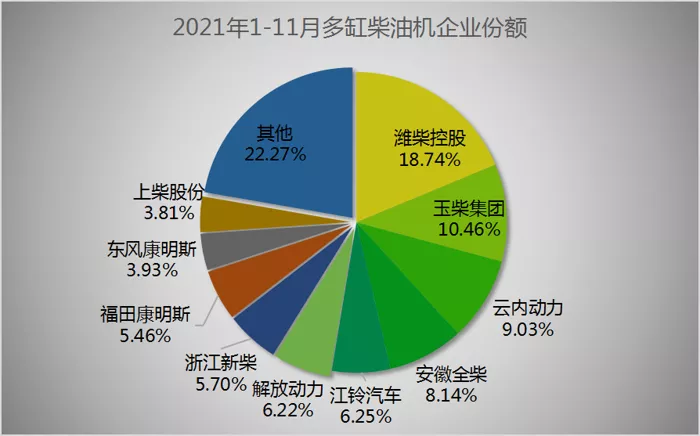

From the market distribution of multi-cylinder diesel engine companies released by the China Internal Combustion Engine Association,From January to November 2021, the cumulative sales of the top ten companies accounted for 77.73%, a decrease of 1.43 percentage points compared to 79.16% in the same period last year. Horizontally, the cumulative sales share of the top ten companies was highest in January, reaching 80.32%, and then gradually narrowed as the months progressed.

Sales and market share of multi-cylinder diesel engines from January to November 2021 and 2020.

From the above table, it can be seen that,From January to November 2021, Weichai Holdings sold a cumulative 922,800 multi-cylinder diesel engines, a year-on-year decrease of 0.65%, with a market share of 18.74%, firmly maintaining the industry lead; Yuchai ranked second, with sales exceeding 510,000 units in the first 11 months, a year-on-year increase of 8.24%, and a market share of 10.46%; Yunnei Power ranked third, with sales of 444,700 units in the first 11 months, a year-on-year decrease of 17.45%, with a share of 9.03%. Among the seven companies outside the top three, five companies still maintained a year-on-year growth trend, namely Anhui Quanchai, Jiangling Motors, Zhejiang Xinchai, Dongfeng Cummins, and Shanghai Diesel Engine Co.; among them, Shanghai Diesel Engine had the highest growth rate in the industry, reaching 34.4%.

Compared to the same period last year, the market pattern has changed significantly. Except for Weichai firmly in first place and Dongfeng Cummins firmly in ninth place, the rankings of other companies in the top ten have changed. Among them, Shanghai Diesel Engine successfully entered the top ten in the industry due to its outstanding market growth in 2021; compared to January to October 2021, the market pattern of multi-cylinder diesel engines only had slight changes, reflected in the position swap between Jiangling Motors and Jiefang Power.Overall,

The multi-cylinder diesel engine market in 2021 experienced significant fluctuations, influenced by many factors, including power cuts, supply and demand contradictions in raw materials, repeated epidemics, and the sluggish demand in the main supporting commercial vehicle market.Multi-cylinder diesel engines for commercial vehicles: Fokang

VS Yuchai, Jiefang VS Yunnei, Shanghai Diesel Engine chasing Dongkang, competition intensifies.Multi-cylinder diesel engines for commercial vehicles can also be referred to as

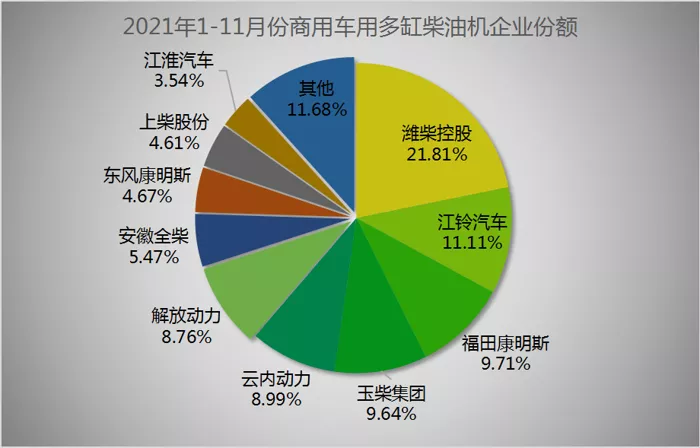

"diesel engines for commercial vehicles." From January to November 2021, the sales of multi-cylinder diesel engines for commercial vehicles were 2.7688 million units, accounting for 56.23% of the multi-cylinder diesel engine market. This means that for every two multi-cylinder diesel engines sold, at least one is used for commercial vehicle matching.However, compared to the continuous narrowing of the cumulative sales share of the top ten multi-cylinder diesel engine companies, the multi-cylinder diesel engines for commercial vehicles present a different picture. Among them,

From January to April 2021, the cumulative share of the top ten companies for multi-cylinder diesel engines for commercial vehicles remained above 89%, reaching as high as 89.88% in February; starting in May, the cumulative share of the top ten fell below 89%, especially from July onwards, it gradually narrowed for five consecutive months. Currently, from January to November, the cumulative share of the top ten companies for multi-cylinder diesel engines for commercial vehicles is 88.32%, which is 0.51 percentage points lower than the same period last year.Sales and market share of commercial vehicle multi-cylinder diesel engines from January to November 2021 and 2020.

From the perspective of companies,

从企业来看,From January to November 2021, Weichai Holding ranked first, with cumulative sales of 603,900 commercial vehicle diesel engines, accounting for 21.81%; followed by Jiangling, with cumulative sales of 307,600 commercial vehicle diesel engines, a year-on-year increase of 2.27%; Foton Cummins and Yuchai competed for third place, with both selling over 260,000 commercial vehicle diesel engines, a difference of about 2,000 units; Yunnei Power and Jiefang Power also had similar sales, both exceeding 240,000 units, with a difference of less than 7,000 units; Quanchai ranked seventh with over 150,000 units, Dongkang and Shangchai both at the 120,000 unit level, and Jianghuai approaching 100,000 units. Overall, the competition in the commercial vehicle diesel engine market intensified further in 2021. Jiangling, Quanchai, Shangchai, and Jianghuai achieved year-on-year positive growth despite the sluggish market, with cumulative sales at a relatively high level.

In terms of market structure, compared tothe period from January to October 2021, there was no change; compared to the same period last year, Jiangling and Quanchai each rose one position, while Foton and Yuchai each rose two positions. Notably, both Jiangling and Quanchai achieved increases in sales and market share of multi-cylinder diesel engines and commercial vehicle diesel engines. Among them, the increase in Jiangling's commercial vehicle diesel engine sales is closely related to the rise in sales of Jiangling light vans, pickups, and the demand for light trucks. According to production and sales reports, Jiangling light vans sold 91,000 units in the first 11 months of 2021, an increase of 13.85%, pickups sold 59,000 units, an increase of 3.4%, and Jiangling truck sales also reached 107,000 units; engine production capacity is also improving, with the 4D30 assembly line capacity optimization project and the PUMA assembly line relocation project both going offline in March, with the assembly workshop's December production target exceeding 9,000 units.

In 2021, affected by factors such as the upgrade to National VI emissions and new regulations for blue-label light trucks, the sales of the commercial vehicle market fluctuated, which in turn led to significant fluctuations in the diesel engine market related to commercial vehicle support. However, various engine companies actively responded, moving forward amid opportunities and challenges, with each showing highlights in market performance.

For example, Weichai's heavy-duty vehicle power performance set a new historical best,with a market share expected to exceed 32% in 2021, and sales of National VI products exceeding 150,000 units, facing the launch of the WP7H engine for the cargo vehicle market in 2022; Yuchai's National VI orders continue to increase, strengthening cooperation with enterprises, and jointly launching strategic new products with Dayun, United Trucks, and Sanhuan; Jiefang Power's Jinwei products continue to increase in Jiefang light trucks, with its Aowei 16L engine "super factory" about to go into production; Foton Cummins, Yunnei Power, Jiefang Power, and Oukan Power have launched new 2.5-liter diesel engines in response to the new regulations for blue-label light trucks; Quanchai is actively adjusting its product structure, taking cost reduction and efficiency enhancement measures, and launching high-end power products for National VI...

Conclusion

As 2022 approaches, industry predictions suggest that the heavy truck market sales may only reach 1 million units, with optimism for the 500-horsepower tractor market, cargo vehicle, and special vehicle markets. At the same time, the new regulations for blue-label light trucks will officially take effect, and the commercial vehicle power market is brewing a major transformation.

Under the multiple effects of the new energy trend and new regulations and opportunities, each engine company will be in2022 to achieve what new breakthroughs?

Latest News