Datong wins the championship, Foton enters the top three, and Shenlong makes it into the top ten. September light commercial vehicle sales ranking.

Release time:

2021-11-02

The light commercial vehicle market, as the largest segment of the bus market, has a significant impact on the overall trends of the bus market. In September 2021, the light commercial vehicle market experienced its first decline of the year, and this "first" is just one of many "firsts" created by the light commercial vehicle market in September this year. According to the latest data from the China Association of Automobile Manufacturers, in September 2021, the sales of buses (including incomplete vehicles) in China reached 39,300 units, a month-on-month increase of 5% but a year-on-year decrease of 9%, marking the first decline of 2021. Among these, the sales of light commercial vehicles were 32,300 units, a year-on-year decrease of 4%, marking their first decline of 2021. This "first" decline in the light commercial vehicle market was also a major reason for the overall decline in the bus market. In September, the sales of 32,300 light commercial vehicles accounted for 82.16% of the entire bus market, an increase from the previous month (81.57%). Looking at the sales and growth trends of light commercial vehicles in September over the past five years, it can be seen that the light commercial vehicle market has shown a pattern of increase-decrease-increase-increase-decrease. The sales of light commercial vehicles in September over the past five years have not varied much, concentrated in the range of 27,000 to 33,000 units, with four years exceeding 30,000 units. The sales of 32,300 units in September 2021 is the second highest in the past five years, about 1,200 units less than the highest sales of 2020. In terms of cumulative sales, from January to September 2021, the light commercial vehicle market sold a total of 309,300 units, the best performance for the first nine months in the past five years. In 2021, the light commercial vehicle market broke through 200,000 units for the first time after June and also surpassed 300,000 units after September for the first time in five years. In previous years, the light commercial vehicle market typically did not exceed 300,000 units until after October, with the years 2018-2020 all breaking through the 300,000 mark in the last month. As shown in the table, the light commercial vehicle market saw a year-on-year decline of 4% in September. Among the top ten companies in September sales, six companies saw growth while four experienced declines. Three companies achieved double-digit growth, with Dongfeng Company, ranked sixth in sales this month, achieving a growth rate of 27%. Foton Motor also saw a sales increase of over 20% in September, reaching 25%, placing it among the top three in monthly sales of light commercial vehicles. Notably, SAIC Maxus topped the monthly sales chart with over 8,000 units sold, a year-on-year increase of 15%, achieving a monthly market share of 25.08%, marking the first time in 2021 that SAIC Maxus ranked first in monthly sales of light commercial vehicles. Additionally, Shenlong Bus made its debut in the top ten of monthly sales with 690 units sold. In terms of market share, the top ten companies accounted for a total of 95.32% of the market in September, with the top five companies holding a combined share of 75.25%. These five companies captured three-quarters of the light commercial vehicle market in September, with the top four companies each exceeding 10% market share. SAIC Maxus was the only company with a monthly share exceeding 20%, reaching 25.08%. The shares for the second to fourth ranked companies, Jiangling, Foton, and Changan, were 17.22%, 12.45%, and 11.82%, respectively, while Nanjing Iveco, ranked fifth in September sales, had a share of 8.69%. From January to September 2021, the light commercial vehicle market achieved a cumulative sales of 309,300 units, a year-on-year increase of 34%, with the cumulative growth rate narrowing by 8 percentage points compared to the previous eight months (+42%), selling about 80,000 units more than the same period last year. Among the top ten companies in September sales, all ten were in the growth range, with SAIC Maxus, ranked second in cumulative sales, achieving a cumulative sales of 59,600 units from January to September, nearly matching its total sales for the entire year of 2020 (59,700 units). The cumulative growth rate reached 57%, selling 21,600 units more than the same period last year. Chongqing Changan, Dongfeng Company, and Nanjing Iveco had cumulative sales growth rates of 51%, 45%, and 36%, respectively, outperforming the overall light commercial vehicle market. Jiangling Automobile, ranked first in cumulative sales, had a cumulative growth rate of 28%, selling 16,400 units more than the same period last year. From January to September 2021, the light commercial vehicle market achieved the only "eight consecutive increases" in the bus market. Although it faced its first decline of the year in September, the light commercial vehicle market has sold about 80,000 units more than the same period last year, which is roughly equivalent to more than two months of sales for the light commercial vehicle market. In 2020, the total sales of the light commercial vehicle market were 344,200 units, and with three months remaining in 2021, it is highly likely that the light commercial vehicle market will exceed last year's total sales after October. Will this indeed happen? We shall wait and see!

The light commercial vehicle market, as the largest segment of the bus market, has a significant impact on the overall trend of the bus market.

In September 2021, the light commercial vehicle market experienced its first decline of the year, and this "first" is just one of many "firsts" created by the light commercial vehicle market in September this year.

According to the latest data from the China Automobile Association, in September 2021, China's bus market (including incomplete vehicles) sold 39,300 units, a month-on-month increase of 5% but a year-on-year decrease of 9%, marking the first decline of 2021. Among these, the light commercial vehicle market sold 32,300 units, a year-on-year decrease of 4%, experiencing its first decline of 2021. This "first" decline in the light commercial vehicle market is also the main reason for the overall decline in the bus market. In September, the sales of 32,300 light commercial vehicles accounted for 82.16% of the entire bus market, an increase from the previous month (81.57%).

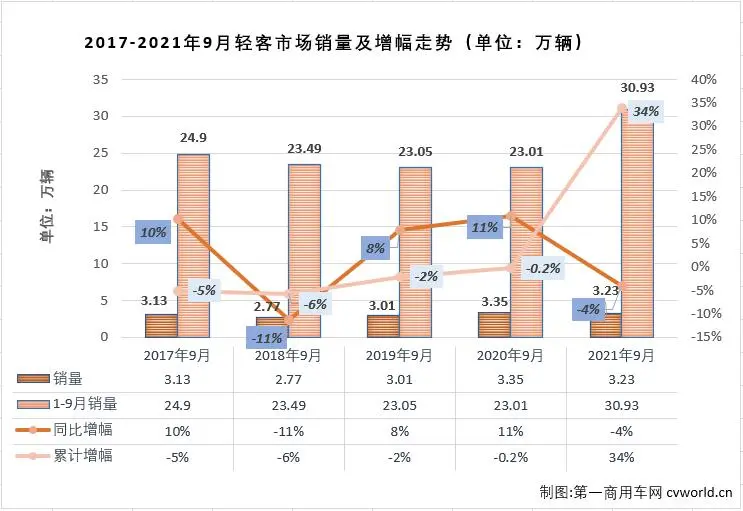

Looking at the sales and growth trend of light commercial vehicles in September over the past five years, it can be seen that the light commercial vehicle market has shown a trend of increase-decrease-increase-increase-decrease in September over the past five years. The sales of light commercial vehicles in September over the past five years have not varied much, concentrated in the range of about 27,000 to 33,000 units, with sales exceeding 30,000 units in four of the five years. The sales of 32,300 units in September 2021 is the second highest in the past five years, about 1,200 units less than the highest sales in September 2020.

In terms of cumulative sales, from January to September 2021, the light commercial vehicle market sold a total of 309,300 units, the best performance for the first nine months in the past five years. In 2021, the light commercial vehicle market broke through 200,000 units for the first time after June, and it also broke through 300,000 units for the first time after September in five years. It is worth noting that in previous years, the light commercial vehicle market did not break through 300,000 units until after October. In the three years from 2018 to 2020, the light commercial vehicle market only broke through the 300,000 unit mark in the last month.

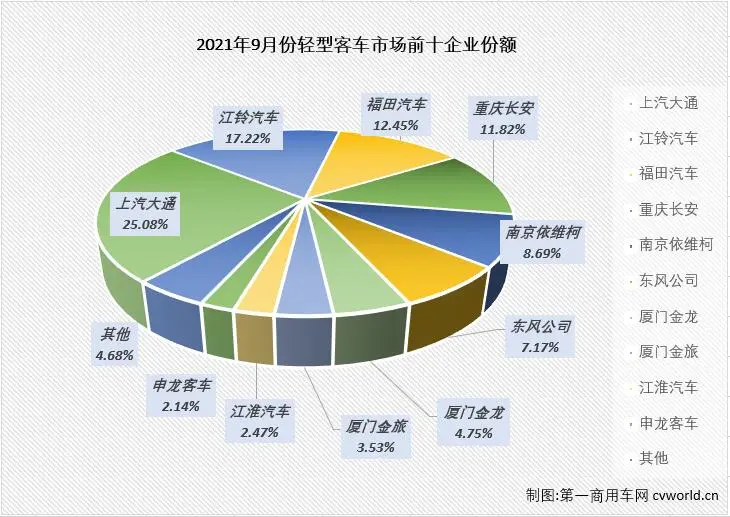

As seen in the table above,In September, the light commercial vehicle market experienced a year-on-year decline of 4%. Looking at the top ten companies by sales in September, six companies saw an increase while four saw a decline. Three companies achieved double-digit growth, with the highest growth being from Dongfeng Company, which ranked sixth in sales this month, reaching 27%. Foton Motor also saw a sales increase of over 20% in September, reaching 25%, placing it among the top three in monthly sales of light commercial vehicles. Notably, SAIC Maxus ranked first in monthly sales with over 8,000 units, achieving a year-on-year growth of 15% and a monthly market share of 25.08%, marking the first time SAIC Maxus topped the monthly sales chart in 2021. Additionally, Shenlong Bus made its debut in the top ten of the monthly sales chart with a performance of 690 units.

In terms of market share, the top ten companies by salesIn September, the total market share reached 95.32%, with the top five companies accounting for 75.25% of the market. These five companies shared three-quarters of the light commercial vehicle market in September, with the top four companies each having a monthly share exceeding 10%. SAIC Maxus ranked first as the only company with a monthly share exceeding 20%, reaching 25.08%. The shares of the second to fourth ranked companies, Jiangling, Foton, and Changan, were 17.22%, 12.45%, and 11.82%, respectively, while Nanjing Iveco, ranked fifth in September sales, had a share of 8.69%.

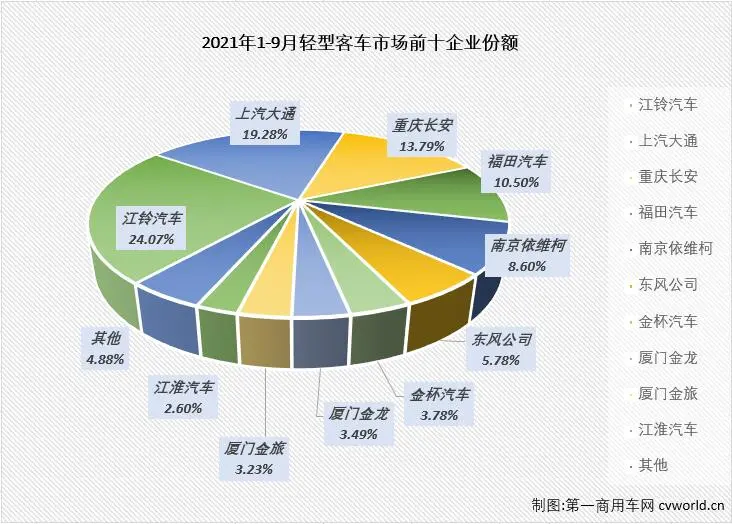

In terms of cumulative sales, from January to September 2021, the light commercial vehicle market sold a total of 309,300 units, a year-on-year cumulative growth of 34%. The cumulative growth rate narrowed by 8 percentage points compared to the previous eight months (+42%), with approximately 80,000 more units sold than the same period last year. Looking specifically at the top ten companies by sales in September, all ten companies were in the growth range, with the highest growth being from SAIC Maxus, which ranked second in cumulative sales, with a total of 59,600 units sold from January to September, nearly matching its total sales for the entire year of 2020 (59,700 units). The cumulative growth rate reached 57%, with 21,600 more units sold than the same period last year. Chongqing Changan, Dongfeng Company, and Nanjing Iveco had cumulative growth rates of 51%, 45%, and 36%, respectively, outperforming the overall light commercial vehicle market. Jiangling Automobile, ranked first in cumulative sales, had a cumulative growth rate of 28%, with 16,400 more units sold than the same period last year.

2021From January to September, the light commercial vehicle market achieved the only "eight consecutive increases" in the bus market. Although it faced its first decline of the year in September, the light commercial vehicle market has sold approximately 80,000 more units than the same period last year, which is roughly equivalent to more than two months of sales for the light commercial vehicle market. In 2020, the light commercial vehicle market sold a total of 344,200 units. With three months remaining in 2021, it is highly likely that the light commercial vehicle market will exceed last year's total sales after October. Will this really happen? We shall see!

Latest News