Weichai has over 810,000 units, with Yuchai's share at 11% and Quanchai at 19%, leading the growth. Diesel engine sales have continued to increase in the first nine months.

Release time:

2021-11-02

In September, the internal combustion engine market, which had been experiencing a continuous decline both month-on-month and year-on-year, finally showed signs of improvement. Although year-on-year sales continued to decline, month-on-month sales achieved double-digit growth, which somewhat alleviated market concerns. According to data from the China Internal Combustion Engine Industry Association, in September this year, 4.0782 million internal combustion engines were sold, representing an 11.11% month-on-month increase and a 13.09% year-on-year decrease. From January to September, cumulative sales of internal combustion engines reached 36.712 million units, with a year-on-year growth of 12.81%, and the cumulative growth rate continued to narrow. The multi-cylinder diesel engines used in commercial vehicles, closely related to the commercial vehicle market, also showed a pattern of month-on-month growth and year-on-year decline: in September, 168,500 multi-cylinder diesel engines for commercial vehicles were sold, a month-on-month increase of 7.33% and a year-on-year decrease of 46.53%. From January to September, cumulative sales reached 2.3985 million units, with a year-on-year growth of 0.54%, barely maintaining positive growth. In the first three quarters, diesel engine sales reached 4.81 million units, a year-on-year increase of 5%. In September, domestic diesel engine sales were 396,000 units, a month-on-month increase of 7.21% and a year-on-year decrease of 33.89%. From January to September, cumulative sales reached 4.8124 million units, with a year-on-year growth of 4.68%. Diesel engines accounted for 13.11% of the total internal combustion engine market, continuing to decline compared to the previous month. In September, sales of multi-cylinder diesel engines for commercial vehicles were 168,500 units, with a month-on-month increase of 7.33% and a year-on-year decrease of 46.53%. From January to September, cumulative sales of internal combustion engines for commercial vehicles reached 2.3985 million units, with a year-on-year growth of 0.54%. In the first three quarters of this year, both diesel engine sales and multi-cylinder diesel engine sales for commercial vehicles have only managed to maintain slight growth. If commercial vehicle sales continue to decline sharply in October, the cumulative sales of diesel engines and multi-cylinder diesel engines for commercial vehicles may shift from growth to decline next month. Multi-cylinder diesel engines: Weichai sold 810,000 units, with Shanghai Diesel and Quan Diesel leading the way. In September, the sales of multi-cylinder diesel engines were no longer experiencing a dual decline in both month-on-month and year-on-year terms, but instead showed month-on-month growth, although the year-on-year decline compared to August widened: in September, 350,900 multi-cylinder diesel engines were sold, a month-on-month increase of 7.69% and a year-on-year decrease of 31.11%. From January to September, cumulative sales of multi-cylinder diesel engines reached 4.2099 million units, with a year-on-year growth of 8.14%, and the cumulative year-on-year growth rate has dropped from double digits to single digits. From January to September this year, the top ten companies in multi-cylinder diesel engine sales were Weichai, Yuchai, Yunnei, Quan Diesel, Jiefang, Jiangling, Xinchai, Foton Cummins, Dongfeng Cummins, and Shanghai Diesel, with the top ten companies maintaining a historically good sales level, accounting for a total market share of 78.21%. The table above shows that from January to September this year, Weichai Holdings sold a cumulative total of 812,100 multi-cylinder diesel engines, a year-on-year increase of 8.25%, with a market share of 19.29%, continuing to hold the top position in the industry. Yuchai ranked second, with cumulative sales of 445,000 multi-cylinder diesel engines from January to September, achieving a market share of 10.57% and a year-on-year growth of 10.86%. Yunnei Power ranked third, with cumulative sales of 390,300 multi-cylinder diesel engines from January to September, a year-on-year decrease of 7.44%, with a market share of 9.27%. The market shares of other companies were as follows: Quan Diesel 7.88%, Jiefang Power 6.44%, Jiangling 5.74%, Xinchai 5.69%, Foton 5.61%, Dongfeng 4.03%, and Shanghai Diesel 3.68%. In terms of rankings, there were no changes in the market rankings from January to September compared to January to August, with the top ten remaining as eight increasing and two decreasing. Among the growing companies, Shanghai Diesel had the highest growth rate, with cumulative sales of 154,900 multi-cylinder diesel engines from January to September, a year-on-year increase of 46.16%, while its market share increased by 0.96%, making it the fastest rising company among the top ten. Apart from Shanghai Diesel, Yuchai, Quan Diesel, Xinchai, and Dongfeng Cummins all had growth rates exceeding 10%, at 10.86%, 19.34%, 11.07%, and 10.33%, respectively. Multi-cylinder diesel engines for commercial vehicles: Weichai accounts for 22.52%, Foton rises to third place. In September, sales of multi-cylinder diesel engines for commercial vehicles were 168,500 units, a month-on-month increase of 7.33% and a year-on-year decrease of 46.53%. From January to September, cumulative sales reached 2.3985 million units, with a year-on-year growth of 0.54%. The top ten in sales were Weichai, Jiangling, Foton, Yuchai, Yunnei, Jiefang Power, Quan Diesel, Dongfeng, Shanghai Diesel, and JAC, with the top ten accounting for a total market share of 88.41%. From January to September, the cumulative sales ranking of companies changed again compared to January to August. Weichai remains the unshakable industry leader. From January to September, Weichai sold a cumulative total of 540,100 units, capturing 22.52% of the market share, a year-on-year decrease of 1%. Jiangling still ranks second, with cumulative sales of 241,800 units from January to September, a market share of 10.08%, achieving a year-on-year growth of 5.67%. In August, Foton Cummins' market ranking rose two places, and in September, Foton Cummins continued to rise one more place, successfully entering the top three in the industry: from January to September, Foton Cummins sold a cumulative total of 236,000 units, with a market share of 9.84%, achieving a year-on-year growth of 2.94%. Yuchai, ranked fourth, had cumulative sales of 234,100 units from January to September, with a market share of 9.76%, a slight year-on-year decrease of 0.18%. Yunnei Power and Jiefang Power still ranked fifth and sixth in the industry, with market shares of 9.41% and 9.1%, respectively. Ranking seventh to tenth are Anhui Quan Diesel, Dongfeng Cummins, Shanghai Diesel, and JAC, all of which achieved year-on-year sales growth and increased market shares. Among them, Shanghai Diesel remains the fastest-growing company with the highest increase in market share: from January to September, it sold 105,300 units, achieving a year-on-year growth of 55.96%, with its market share rising by 1.56% to 4.39%. Conclusion In the first three quarters of this year, the cumulative sales of diesel engines and multi-cylinder diesel engines for commercial vehicles have barely maintained positive growth, but the situation is not optimistic. October is likely to become a turning point for the cumulative sales growth rate of the diesel engine market to turn negative. What kind of results can each company achieve at that time? What changes will occur in the market landscape? Please continue to pay attention.

In September, the internal combustion engine market, which had been experiencing a continuous decline both month-on-month and year-on-year, finally showed some improvement. Although the year-on-year sales are still declining, the month-on-month sales achieved double-digit growth, which can bring some comfort to the market.

According to data from the China Internal Combustion Engine Association, in September this year, 4.0782 million internal combustion engines were sold, an increase of 11.11% month-on-month, but a decrease of 13.09% year-on-year; from January to September, a total of 36.712 million internal combustion engines were sold, a year-on-year increase of 12.81%, with the cumulative growth rate continuing to narrow.

The multi-cylinder diesel engines for commercial vehicles, closely related to the commercial vehicle market, also showed a trend of month-on-month growth and year-on-year decline: in September this year, 168,500 multi-cylinder diesel engines for commercial vehicles were sold, an increase of 7.33% month-on-month, but a decrease of 46.53% year-on-year; from January to September, a total of 2.3985 million multi-cylinder diesel engines for commercial vehicles were sold, a year-on-year increase of 0.54%, barely maintaining positive growth.

In the first three quarters, 4.81 million diesel engines were sold, a year-on-year increase of 5%.

In September, domestic diesel engine sales reached 396,000 units, a month-on-month increase of 7.21%, but a year-on-year decrease of 33.89%; from January to September, cumulative sales reached 4.8124 million units, a year-on-year increase of 4.68%. Diesel engines accounted for 13.11% of the total internal combustion engine market, continuing to decline compared to the previous month.

In September this year, 168,500 multi-cylinder diesel engines for commercial vehicles were sold, an increase of 7.33% month-on-month, but a decrease of 46.53% year-on-year; from January to September, a total of 2.3985 million internal combustion engines for commercial vehicles were sold, a year-on-year increase of 0.54%.

In the first three quarters of this year, both diesel engine sales and multi-cylinder diesel engine sales for commercial vehicles could only maintain weak growth. If commercial vehicle sales continue to decline sharply in October, then next month the cumulative sales of diesel engines and multi-cylinder diesel engines for commercial vehicles may shift from growth to decline.

Multi-cylinder diesel engines: Weichai sold 810,000 units, Shangchai and Quanchai led the growth.

In September, the sales of multi-cylinder diesel engines were no longer a double decline month-on-month and year-on-year, but achieved month-on-month growth, although the year-on-year decline compared to August widened: in September, 350,900 multi-cylinder diesel engines were sold, a month-on-month increase of 7.69%, but a year-on-year decrease of 31.11%; from January to September this year, a total of 4.2099 million multi-cylinder diesel engines were sold, a year-on-year increase of 8.14%, with the cumulative year-on-year growth rate having dropped from double digits to single digits.

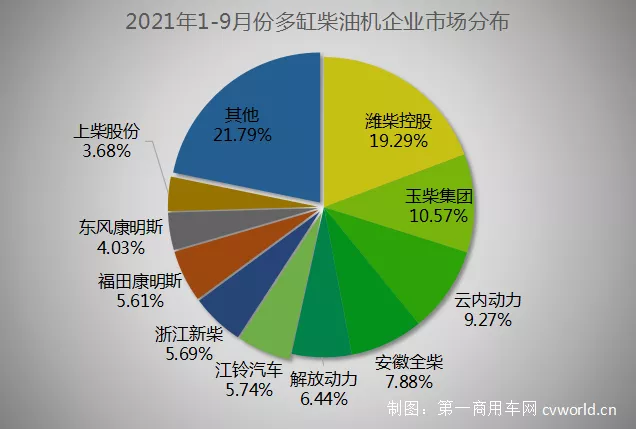

From January to September this year, the top ten companies in multi-cylinder diesel engine sales were Weichai, Yuchai, Yunnei, Quanchai, Jiefang, Jiangling, Xinchai, Foton Cummins, Dongfeng Cummins, and Shangchai. The sales of the top ten were all at historically good levels, with a total market share of 78.21%.

Sales of multi-cylinder diesel engines by various companies from January to September 2021.

The table shows that from January to September this year, Weichai Holdings sold a cumulative total of 812,100 multi-cylinder diesel engines, a year-on-year increase of 8.25%, with a market share of 19.29%, continuing to hold the first place in the industry. The second place, Yuchai, sold a cumulative total of 445,000 multi-cylinder diesel engines from January to September, with a market share of 10.57%, achieving a year-on-year increase of 10.86%. Yunnei Power ranked third, with cumulative sales of 390,300 multi-cylinder diesel engines from January to September, a year-on-year decrease of 7.44%, with a market share of 9.27%. The market shares of other companies were: Quanchai 7.88%, Jiefang Power 6.44%, Jiangling 5.74%, Xinchai 5.69%, Fokang 5.61%, Dongkang 4.03%, Shangchai 3.68%.

In terms of rankings, compared to January to August, the market rankings from January to September did not change, with the top ten in the industry still being 8 increases and 2 decreases. Among the growing companies, Shangchai had the highest growth rate, with cumulative sales of 154,900 multi-cylinder diesel engines from January to September, a year-on-year increase of 46.16%, while its market share increased by 0.96%, making it the fastest rising among the top ten companies. Excluding Shangchai, Yuchai, Quanchai, Xinchai, and Dongfeng Cummins had growth rates exceeding 10%, at 10.86%, 19.34%, 11.07%, and 10.33% respectively.

Multi-cylinder diesel engines for commercial vehicles: Weichai accounts for 22.52%, Fokang rises one place to third.

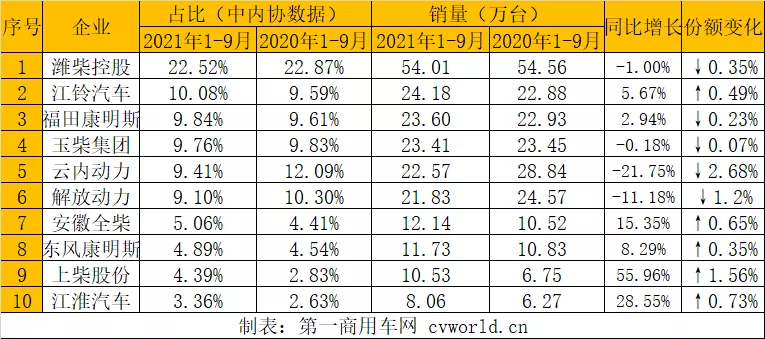

In September, 168,500 multi-cylinder diesel engines for commercial vehicles were sold, a month-on-month increase of 7.33%, but a year-on-year decrease of 46.53%; from January to September, cumulative sales reached 2.3985 million units, a year-on-year increase of 0.54%. The top ten in sales were Weichai, Jiangling, Fokang, Yuchai, Yunnei, Jiefang Power, Quanchai, Dongkang, Shangchai, and Jianghuai, with a total market share of 88.41%.

Sales of multi-cylinder diesel engines for commercial vehicles by various companies from January to September 2021.

Compared to January to August, the cumulative sales rankings of companies from January to September have changed again. Weichai remains the unshakable industry leader. From January to September this year, Weichai sold a cumulative total of 540,100 units, capturing 22.52% of the market share, a year-on-year decrease of 1%. Jiangling Automobile remains in second place, with cumulative sales of 241,800 units from January to September, a market share of 10.08%, achieving a year-on-year increase of 5.67%. In August, Foton Cummins' market ranking rose two places, and in September, Foton Cummins continued to rise one place, successfully entering the top three in the industry: from January to September, Foton Cummins sold a cumulative total of 236,000 units, with a market share of 9.84%, achieving a year-on-year increase of 2.94%. Yuchai, ranked fourth, had cumulative sales of 234,100 units from January to September, with a market share of 9.76%, a slight year-on-year decrease of 0.18%. Yunnei Power and Jiefang Power still rank fifth and sixth in the industry, with market shares of 9.41% and 9.1% respectively.

Ranking seventh to tenth are Anhui Quanchai, Dongfeng Cummins, Shangchai, and Jianghuai Automobile, all of which achieved year-on-year sales growth, and their market shares also increased. Among them, Shangchai remains the fastest-growing company with the highest increase in market share: from January to September, it sold 105,300 units, achieving a year-on-year increase of 55.96%, with its market share rising by 1.56% to 4.39%.

Conclusion

In the first three quarters of this year, the cumulative sales of diesel engines and multi-cylinder diesel engines for commercial vehicles can barely maintain positive growth, but the situation is not optimistic. October is likely to become a turning point for the cumulative sales growth rate of the diesel engine market to turn negative. What kind of results can each company achieve at that time? What changes will occur in the market structure? Please continue to pay attention.

Latest News